The market for renewable hydrogen and water electrolysis continued to grow in 2022 as compared to 2021, both in Europe and globally, according to a JRC status report on the development of hydrogen technology.

In Europe – including the EU, EFTA countries and the UK – the total installed electrolysis capacity grew from 85 MW in 2019 to 162 MW (expressed in electrical power input) as of August 2022, estimates show. By the end of 2023, short-term estimates point to a capacity to reach at least 191 MW and up to an optimistic 500 MW. By the end of 2025, 1 371 MW of electrolysis capacity are planned to enter operation in Europe.

However, despite clear signs of growth, expected to accelerate in 2023, the volumes of renewable hydrogen currently produced compared to fossil-based hydrogen are still negligible (0.2%), according to the report.

Beyond Europe, estimations of global installed electrolysis capacity are in the range of 600 - 700 MW at the end of 2022. Latest available information suggests a global capacity reaching the 2 GW mark by the end of 2023.

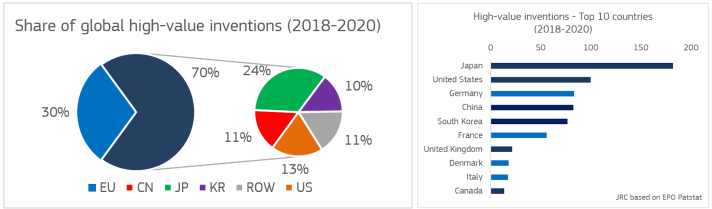

Europe’s cumulative deployments are accelerating, and deployment plans are growing year after year. The EU is strong on regulatory framework with funding and financing support schemes and European companies have a strong presence as international patent holders. When it comes to high value inventions, EU is still leading with (31% of total share) alongside Japan. Europe is active in R&D actions spanning the whole continent and has a leading global scientific publication record together with China and the US.

The report provides a review of the technology development, trends, value chains, and markets and competitiveness for hydrogen. Hydrogen bears the potential to decarbonise hard-to-abate sectors which are difficult to electrify directly, hence play a crucial role in achieving the net zero emission targets in 2050.

Amongst projected uses, renewable hydrogen can have a prominent role in decarbonising industrial processes, such as oil refining, the production of steel and cement, ammonia and fertilisers, or can be used as fuel in the heavy duty and long-distance transport (including solutions for e-fuels in aviation and maritime transport). Finally, it can be used in support of energy storage systems, especially for seasonal applications.

EU’s targets, set out in the RePower Plan and the Hydrogen strategy, envisage EU domestic production of 10 Mt renewable hydrogen and import of as many Mt (of which 4Mt in the form of ammonia).

If 10 Mt of renewable hydrogen were to be produced exclusively through water electrolysis, the European hydrogen industry estimates a need for 140 GW of electrolysis capacity installed by 2030.

As of 2023, more than 50 countries had released at least a national hydrogen strategy or roadmap, demonstrating the growing interest worldwide.

Technology readiness

Water electrolysis remains the most mature and promising technology for producing renewable hydrogen from non-carbon sources. Among the five main electrolysers technologies identified, two – Alkaline and Proton Exchange Membrane – have achieved commercial maturity for large-scale applications and have been, or will be, deployed in demonstrations reaching a power of hundreds of megawatts.

The challenges

Europe is strongly dependent on imported raw materials, but its global share grows progressively for processed materials and components, reaching a significant fraction when final products are considered. More than 40 raw materials and 60 processed materials are required in electrolyser production. Major suppliers of raw materials for electrolysers are China (37%), South Africa (11%) and Russia (7%), while the EU share is only 2%.

Other major perceived challenges will be the contractualisation and securisation of sizeable demand for renewable hydrogen and the deployment of an adequate supply of renewable electricity, which can be a crucial bottleneck towards the path of achieving European strategic production goals for renewable hydrogen.

Background

Background

This report is compiled by the Clean Energy Technology Observatory (CETO). The objective of the observatory is to provide an evidence-based analysis feeding the policy making process – this would increase the effectiveness of R&I policies for clean energy technologies and solutions.

CETO monitors EU R&I activities on clean energy technologies needed for the delivery of the European Green Deal, and assesses the competitiveness of the EU clean energy sector and its positioning in the global energy market.

The observatory is run by the JRC for the Commission’s Directorate-General for Research and Innovation, in coordination with the Directorate-General for Energy.

Related links

Water Electrolysis and Hydrogen in the European Union – 2022 Status Report

Details

- Publication date

- 24 November 2023

- Author

- Joint Research Centre

- JRC portfolios