The global soil erosion rate is projected to increase by 30% to 66% over the period 2015–2070 under three alternative climate-economic scenarios, according to a JRC study. The current impact of soil erosion on agricultural productivity at global scale has been estimated at about USD 8 billion.

The three climate-economic scenarios considered in the study are “Sustainability” (RCP2.6-SSP1), “Middle of the road “(RCP4.5-SSP2) and “Fossil fuel development” (RCP2.6 – RCP8.5). The first refers to keeping global warming to less than 2°C above pre-industrial temperatures and lower socio-economic mitigation challenges, the second to trends that largely follow historical patterns. The third is a worst-case scenario with very high level of GHG emissions and strong fossil-fuel-driven socio-economic development.

JRC scientists used an integrated quantitative modelling approach to estimate the long-term impact of soil erosion on land degradation worldwide. While previous studies focused on specific regions, none carried out a longer-term prospective analysis of the global market impacts of soil erosion. This study aims to fill that gap.

JRC scientists used the Global Soil Erosion Modelling (GloSEM) platform with the Revised Universal Soil Loss Equation (RUSLE) model to generate updated estimates of future erosion scenarios.

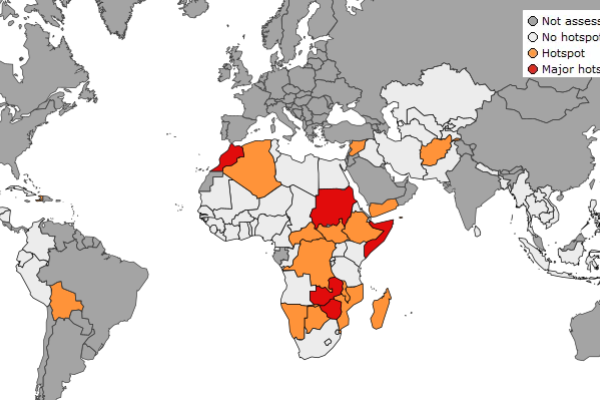

By converting the projected soil erosion rates into land productivity losses and integrating them into the economic global simulation model Modular Applied GeNeral Equilibrium Tool (MAGNET), the authors of the study identified the regional hotspots where greatest market tensions could happen.

Macroeconomic impact and agricultural production

Depending on the scenario, the total real GDP loss over the period 2015-2070 will range from USD 216 billion to USD 625 billion at the global level. This amounts to a loss of between 0.06% and 0.12% of global GDP, with an annual loss ranging between USD 4 billion and USD 11 billion.

Soil erosion could also present an acute challenge to food security in vulnerable regions in Africa and in the tropics, where the threat of shortages in crops such as oilseeds and horticulture is potentially significant. Under the worst-case scenario, global primary agricultural production losses could amount to 352 million tonnes of crops by 2070.

Reduced land productivity due to soil erosion leads to increased demand for land, which also raises the per capita footprint. The soil erosion losses will provoke an increase in land used for food consumption to 167,000 km2, equivalent to the area of Tunisia, and increased demand for water supply of 10 billion m3.

The most affected countries are in Central-South Africa and India, followed by Indonesia and China due to increased soil losses caused by climate change. EU-27 and the rest of Europe are predicted to have low productivity and economic losses. The EU-27 comes out on top in terms of increased agricultural production in all three scenarios due to its broader base of crop production and greater agricultural trade exposure, which enables it to take advantage of its relative competitive gains.

JRC scientists show that international trade helps cushion global markets against the risk of a drop in global production and the threat of agricultural commodity price increases. They conclude that a greater opening of these markets and free and fair trade would help to reduce such risks even further.

Related links

Details

- Publication date

- 9 February 2024

- Author

- Joint Research Centre

- JRC portfolios