A JRC analysis of 10 new trade agreements, concluded or under negotiation, finds that EU exports to the 10 partners will increase strongly: by 27% (EUR 3.5 billion) in a conservative scenario and by 38% (EUR 4.8 billion) in an ambitious scenario, as compared to a baseline in 2032. The two scenarios refer to different liberalisation patterns in 2032 and are compared to a baseline trade projection in the same year without the implementation of the selected trade agreements.

The results of the modelling exercise are published in a study focusing on the economic impact on EU agriculture, looking into trade, production and prices.

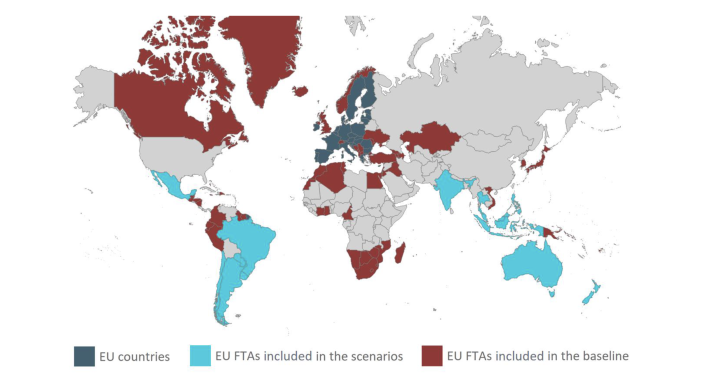

The study considers the FTAs for which negotiations have been recently concluded by the EU, but which have not been adopted or entered into force yet, i.e. those with Mercosur (Argentina, Brazil, Paraguay and Uruguay) and New Zealand, and the updated agreements with Chile and Mexico, as well as trade agreements under negotiation with Australia, India, Indonesia, Malaysia, the Philippines and Thailand.

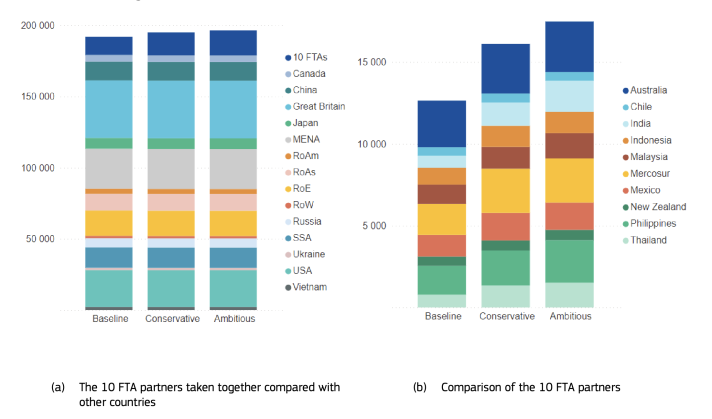

It is expected that, by 2032, without the implementation of the bilateral trade agreements, these 10 countries and regions will account for 6.6% (EUR 12.6 billion) of EU agri-food exports and 28.2% (EUR 32.2 billion) of EU agri-food imports.

Considering all EU trade partner countries, EU agri-food exports would increase by 1.6% (EUR 3.1 billion) in the conservative scenario and by 2.3% (EUR 4.4 billion) in the ambitious scenario.

As for imports, EU total agri-food imports in the conservative and the ambitious scenarios increase by 2.7% (EUR 3.1 billion) and by 3.6% (EUR 4.1 billion), respectively. This results from increased EU import of all agri-food products from the 10 FTA partners by 11% (EUR 3.5 billion) in the conservative scenario and by 14.5% (EUR 4.7 billion) in the ambitious scenario. The highest increase in EU imports value is attributable to Mercosur countries.

Even though the EU is a net importer vis-a-vis the considered 10 trade partners, the agreements would benefit both EU exports and imports, resulting in a balanced increase of trade.

Overall, the EU agri-food trade balance increases by EUR 25 million and EUR 311 million in the conservative and ambitious scenario respectively.

The 10 upcoming trade agreements will create additional markets for EU agri-food products and diversify trade sources. This, in turn, will make the EU less dependent on a limited number of trade partners for key commodities, improving the resilience of EU food supply chains and contributing to increased food security for European consumers.

What will trade bring for different EU agri-food sectors?

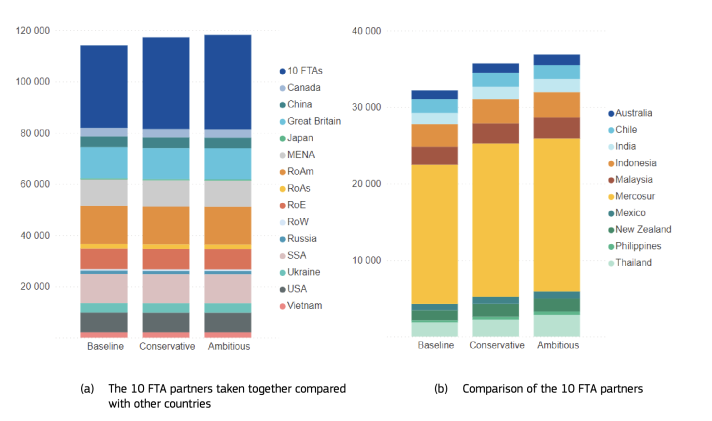

Trade opportunities are expected to arise for some agri-food commodities such as dairy, pig meat, wine and other beverages, and processed agri-food products.

In the ambitious scenario, exports to all countries of processed products increase by 2.1% (EUR 1.3 billion) compared to the 2032 baseline, wine, and beverages (and tobacco) by 1.6% (EUR 654 million) and dairy products by 4.8% (EUR 780 million). Also, pig meat exports would increase by 5.4% (EUR 566 million) under the ambitious scenario, corresponding to about 118 000 tonnes in carcass weight equivalent.

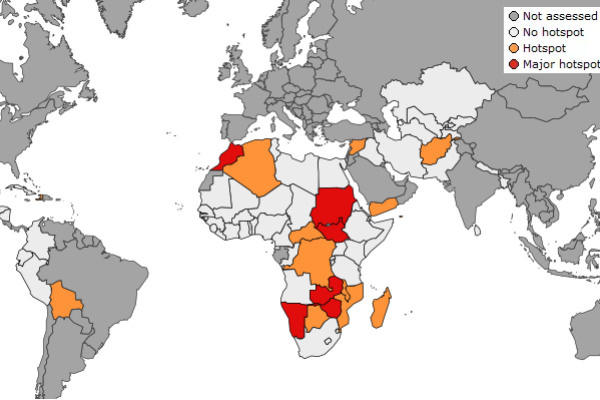

On the flipside, certain sectors, such as beef, sheep meat, poultry, rice, and sugar, are expected to face increased competition from the 10 FTA partners.

Import values for meats sectors are estimated to increase, with potential increases of up to 3.9% (6,000 tonnes) for sheep meat, 24% (91,000 tonnes) for beef, and 28.3% (274,000 tonnes) for poultry in the ambitious scenario. Such increases are primarily attributed to increased imports from Mercosur, Australia, New Zealand, and Thailand.

Consequently, EU production across all meat sectors is expected to slightly decline (by c.1-2%, depending on the sector). This will lead to a similar trend in domestic producer prices where producer prices for all meat sector – except for pig meat – would decrease.

For beef, producer prices are projected to fall by around 2.4% in both scenarios, and for sheep by 2.7% in the ambitious scenario (1.9% in the conservative), while poultry producer prices are almost unaffected. For pig meat in the ambitious scenario, the price increases by 1.3% (in the conservative by 0.4%).

The relatively low impact on EU production and prices is primarily because these increases in imports are vastly smaller than the total volumes of EU production.

The import of sugar is projected to increase by 13% (200,000 tonnes), exerting a smaller impact on domestic production and producer prices. The rice sector is also expected to face some decline in EU production and producer prices and increase imports.

The UK trade agenda

The UK has recently signed agreements with Australia, and New Zealand, and entered the accession procedure for the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). These agreements could impact EU export opportunities on the UK markets for agri-food products, particularly beef and sheep meat.

The UK trade agenda would result in some small negative impacts on EU agri-food exports as a whole, but significant for some sensitive sectors. Nonetheless this negative effect can be mitigated by EU FTAs, particularly under an ambitious liberalisation approach.

The positive impact on EU trade balance stemming from the 10 FTAs outweighs the losses from the UK trade agenda in the ambitious scenario, maintaining a positive trade balance (EUR 40 million). Under the conservative scenario, the positive trade balance from the 10 FTAs will not fully compensate the impact from the UK trade agenda and the combined result on the trade balance will be negative (EUR -213 million).

Thus, by adopting an ambitious FTA approach the EU can better compensate for the small trade deficit generated by the UK trade agenda, by opening market opportunities in other countries.

Background

The study is the third JRC analysis of the cumulative economic impact of upcoming EU free trade agreements. The previous studies were published in 2016 and 2021 and have also covered the trade deals with Canada, Japan and Viet Nam, currently in force. These, as well as other agreements, such as those with South Korea and Ukraine, in force for a long time, are integrated into the 2032 baseline.

An interactive infographic complements the scientific report as a tool to visualise all the model results included in the study.

Related links

Cumulative economic impact of upcoming trade agreements on EU agriculture

Press release: Study confirms that EU trade opens new commercial opportunities for EU agri-food exporters

Details

- Publication date

- 22 February 2024

- Author

- Joint Research Centre

- JRC portfolios