The top 2500 R&D investors in the world set a record for total investment in 2022, amounting to nearly €1.25 trillion, says the EU Industrial 2023 R&D Investment Scoreboard. This is approximately 86% of the world's business-funded R&D, coming from companies based in 42 countries.

Last year, they spent €141 billion more to the development of new products and technologies in comparison to 2021. The investment went mainly to four sectors: ICT producers, ICT services, health and automotive industries, responsible for more than three quarters of the total R&D investment.

In its 20th edition, the report continues to provide economic and financial data and analysis of the top global corporate R&D investors. This analysis is based on company data extracted directly from their own annual reports.

More than a third of companies and 43% of global R&D investment come from the ICT producers and ICT services sectors, the latter one being the fastest growing in the past decade. Meanwhile, among the world’s top R&D investors, most come from the health sector, together accounting for more than a fifth of investment.

Overall, US companies are responsible for over 40% of the R&D investment of the largest 2500 corporate R&D investors, while EU and China closely compete for second place, with 17.5% and 17.8% shares respectively.

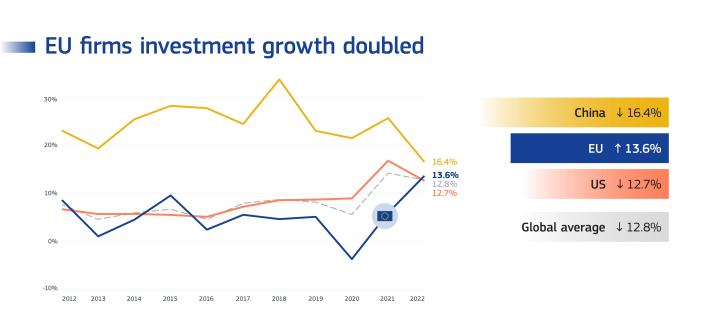

EU firms accelerate investment growth for two consecutive years

Last year, EU private R&D investment growth surpassed the global average of 12.8% while more than doubling its growth rate in 2021 (6%). It reached its highest rate since 2015 (13.6%), whereas both US companies and China’s experienced a slowdown when compared to 2021.

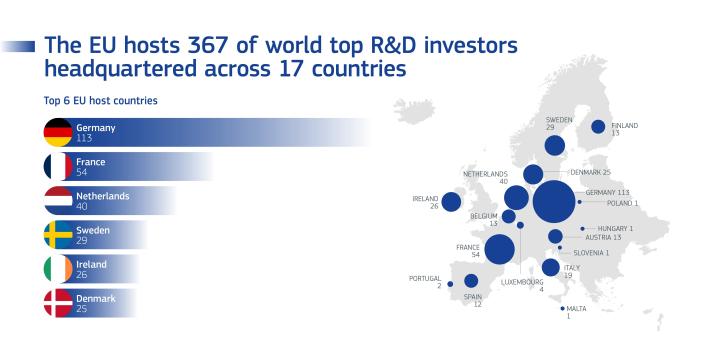

The EU hosts 367 of the 2500 world top R&D investors headquartered across 17 countries. Half of the companies are in Germany, France and The Netherlands, concentrating 73% of private R&D investment in the EU. Looking at the EU top 1000 R&D investors, 18% of are small and medium sized enterprises (SMEs), about two-third of which come from the health sector.

The EU also continues to lead in investments by the automotive sector (42.2%) worldwide, followed by Japan and the US, with 19.5%. However, sectoral distribution in Europe shows a much broader representation with automotive sector accounting for 32% of R&D investments, followed by health (19.7%), ICT producers (14.4%) and ICT services (8%). Other sectors are also strong such as aerospace and defence (3.8%), financials (3.8%), energy (2.7%), chemicals (2.6%) and construction (0.9%).

Companies ranking led by ICT

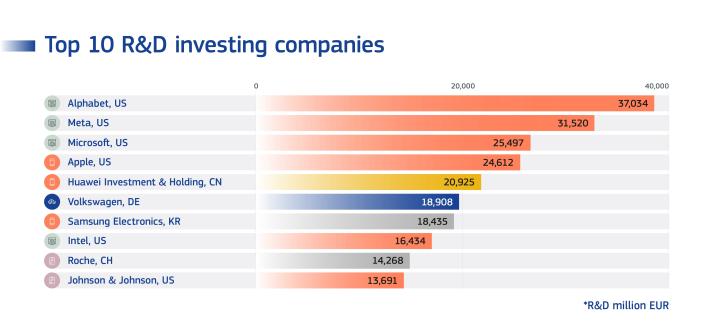

US ICT companies Alphabet, Meta, Microsoft and Apple lead the global Scoreboard ranking, followed by Huawei from China and Volkswagen from the EU.

There are 12 EU-based firms in the top 50 global ranking, along with 23 US-based firms, and five each from Japan, China, and the rest of the World (mainly Switzerland and the UK).

The Scoreboard is published annually to provide a reliable, up-to-date benchmarking tool for comparisons between companies, sectors, and geographical areas, as well as to monitor and analyse emerging investment trends and patterns. It provides an R&D investment database that companies, investors and policymakers can use to compare individual company performances against the best global competitors in their sectors.

Related links

EU Industrial 2023 R&D Investment Scoreboard

Economics of Industrial Research and Innovation

Press release: EU companies doubled R&D investment growth in 2022

Details

- Publication date

- 14 December 2023

- Author

- Joint Research Centre

- JRC portfolios