Today's Mid-term Review of the Capital Markets Union (CMU) Action Plan took stock of the progress towards better funding and investment opportunities and economic resilience. JRC has provided support for the economic analysis and econometric modelling to find out where we stand with financial integration.

Capital Market Union Key indicators

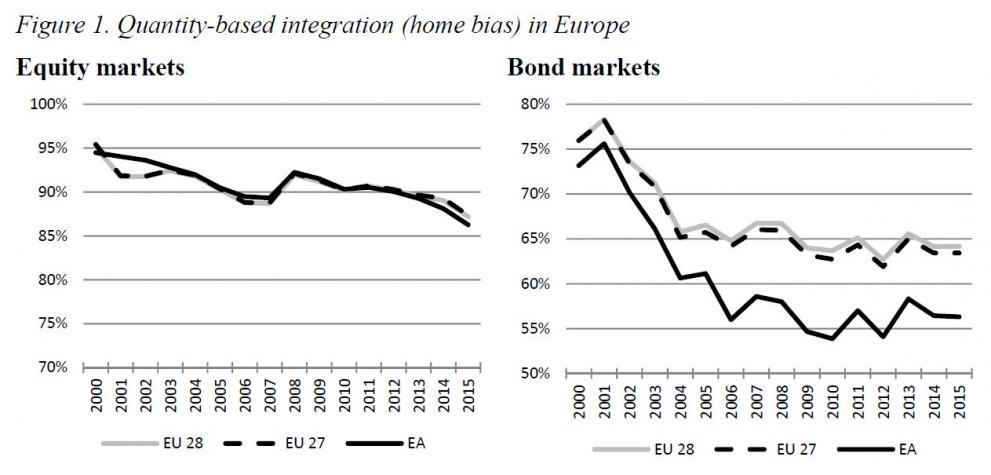

The Joint Research Centre (JRC), the Commission’s in-house science service, supplied crucial technical support in measuring progress towards integration of EU capital markets. It provided the modelling, economic analysis and some key indicators to monitor the advancement of CMU. Among others, it estimated the degree of EU integration in the equity and bond markets showing that integration is on a steady recovery after the crisis, despite some signs of stagnation in price-based indicators. It also identified significant home bias, i.e. an overwhelming percentage of investment portfolios are in the national markets, especially in the equity market, but again on a downward trend since the financial crisis. Another finding is the decreasing diversification of cross-border debt holdings. Home bias and lack of diversification have prevented the international capital markets to significantly cushion the negative effect of the sovereign crisis and share risks across EU countries.

Positive signs and the way forward

Home bias remains very high, especially in equity instruments but it is steadily decreasing since 2011 (see Figure 1).There are clear indications that financial integration is moving towards a more sustainable path, although the diversification of the financial system in Europe is still far from optimal.

Close collaboration among Commission services

To provide these insights, the JRC Financial and Economic Analysis team constructed and estimated econometric models and indices based on commercial data and the Finflows dataset run jointly between the JRC and Directorate-General for Economic and Financial Affairs (ECFIN), as well as. FinFlows covers bilateral cross-border investment stocks and flows and uses multiple data sources (OECD, IMF-CPIS, IMF-CDIS, BIS, ESTAT). The JRC collaborates closely with DG Financial Stability, Financial Services and Capital Markets (FISMA), which is in charge of CMU’s design, implementation and monitoring.

Background

The Capital Markets Union Action Plan sets out key measures to achieve a true single market for capital in the European Union, with the aim of mobilising capital to achieve economic growth and create jobs. It also aims at promoting financial stability by facilitating a more diversified set of funding channels. The Mid-Term Review also sets the timeline for the new actions that will be unveiled in the coming months. These will include a pan-European personal pension product to help people finance their retirement.

Related Content

Communication on Capital Markets Union- Accelerating Reform

Details

- Publication date

- 8 June 2017