Climate impacts occurring outside Europe (rest of the world) can affect the European economy because the global economy is closely interconnected. Countries buy (import) and sell (export) products and services to each other via international trade. For instance, if climate change damages the agriculture crops in China, it will have also effects on the European economy due to those international economic connections. Climate impacts elsewhere may affect EU's economic performance, such as imports, exports, sectoral production, employment and prices.

All those economic effects will affect, in the end, on the overall economic activity, defined in terms of Gross Domestic Product (GDP). The impacts in Europe due to the climate damages in the rest of the world are called transboundary or spillover effects, usually measured as a GDP change.

The magnitude of the transboundary effect for a specific type of climate impact will mainly depend on the size of the direct climate effect (the larger the damage, the larger the transboundary effect) and on the volume of the international trade between the 'country source' and the 'country destination' of the transboundary effect (the more trade among the two countries, the larger the transboundary effect).

Explanation of the map

The JRC PESETA III project has made a first assessment of the transboundary effects on Europe associated with international trade. Four climate impact categories have been considered: agriculture, labour productivity, energy and river floods.

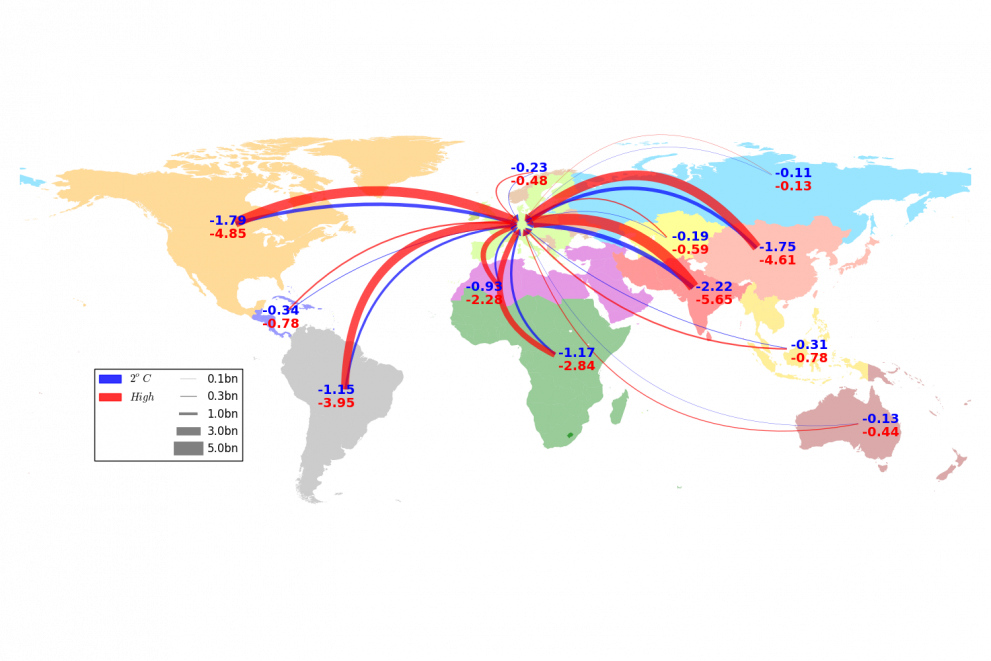

The map below (published in page 3 of the Report on the Implementation of the EU's adaptation strategy) provides an assessment of the transboundary effects on the EU, in terms of losses of annual EU GDP (in billion Euros) for the sum of the four mentioned climate impact areas. The numbers on the regions reflect the GDP losses in Europe due to climate impacts occurring in those regions. Results from the two main PESETA scenarios are presented: a high-emissions scenario (in red) and a 2ºC world (in blue). For instance, under the high-emissions scenario, the EU would have a 3.95 billion Euros GDP loss due to climate impacts in Latin America. The sector that channels most of the transboundary effects is agriculture, followed by labour productivity.

Impacts on annual EU GDP (billion Euros) due to climate impacts in the rest of the world regions, via international trade (imports and exports)

How it has been calculated?

The estimates of the transboundary effects have been made with an economic multi-country model (a computable general equilibrium model, CGE) that takes into account the import and export flows between all countries; it also considers that the economy is divided into a set of sectors. The general equilibrium model quantifies how the initial equilibrium in all the markets of the economy (e.g. goods, services, labour, capital) will be adjusted to accommodate the climate shock.

The model is able to simulate how the various climate shocks will affect the rest of the world countries, such as flood, productivity change or damage to residential buildings, and also allows for estimation of the economic effects in the region of impact (the EU). The transboundary impacts in Europe are computed considering the bilateral international trade linkages, which serve as a vehicle for the climate transboundary effects, enabling the estimation of the magnitude of the transboundary effects in other regions. The model also evaluates private consumption and the relevant welfare implications.

Another advantage of the CGE methodology is that it captures market adaptation, i.e. how all markets of the economy react to climate change. For instance, when the agriculture productivity is affected by climate change, the agriculture sector and all other sectors of the economy are adjusted via the economy price system. This is a general and broad process that affects all production factor and good markets of the country impacted by climate and also the same markets in the countries with which the country has trade relationships.

Illustration of the economic adjustments

Here there is an illustration of the kind of economic effects that would affect Europe due to climate change in the rest of the world. Let assume that China produces 11% less crops (which lead to a 16% higher price) due to end-of-century climate change, as simulated by the JRC PESETA III project. This will have a series of knock-on effects on the EU economy: affecting EU imports, exports and consumption which, in the end, will affect the EU's GDP.

Indeed, GDP, from its expenditure side, has five main components: consumption, investment, government expenditure, exports and imports, hence any change in GDP is induced by changes in its constituent components. The example presented here examines how the direct climate impact in China affects the GDP components in the EU. For simplicity, and because of the static comparable framework used for the analysis, the government expenditure and investment are held constant.

First of all, regarding EU exports to China, they would be reduced due to the lower overall economic activity in China, induced by the lower performance of the agricultural crops sector (fall in agriculture yields). The lower production levels in China translate into reduced imports from other countries (exports to China from those countries, including the EU exports to China). The reduction in exports would contribute about 0.016% to the GDP decrease of the EU economy.

The second effect relates to consumption: The reduction in EU net exports leads to a reduction in the EU's production, as seen before, which implies lower employment and lower wages; they then reduce the household income, leading as a consequence to a reduction in consumption, which again decreases EU's GDP, by about 0.012%.

The third effect relates to imports, which would also decrease. The EU will import less from China because its products become more expensive. As agricultural yields in China are reduced due to climate change, that increases the prices of crops and other related goods (goods buying crops like the agro-food industry). The EU markets would substitute away from the more expensive imports, and the overall imports would be reduced by about 0.04%. The lower imports would induce a positive effect on the EU GDP, of about 0.014%. Imports detract GDP, therefore a reduction of imports implies a rise in GDP.

In sum, the effect of reduced crops productivity in China on the EU economy's GDP is the aggregation of those three components: lower exports (decreasing GDP), lower consumption (reducing GDP) and lower in imports (increasing GDP). For the numerical case of the scenarios considered in the JRC PESETA III project, the net effect is a reduction of GDP in the EU due to agriculture yield losses in China.