Redistributing environmental tax revenue can help support households facing increasing energy and transport costs, according to a new JRC report.

The report finds that means-tested renovation subsidies and targeted lump sum transfer schemes can be key tools to rebalance the overexposure of financially vulnerable citizens to rising costs.

The authors argue that this redistribution needs to be carefully targeted in order to be effective.

The EU has set strong targets to be climate neutral by 2050. Energy taxation is vital to achieving this goal.

Well-designed taxes send the right price signals and incentives to reduce greenhouse gas emissions, increase energy efficiency, and hold accountable those who contribute to negative environmental impacts.

At the same time, these taxes raise the price people have to pay for energy to heat their homes or fuel their vehicles. Poorer households are at higher risk of becoming overburdened by these increases.

In 2018, the revenue from environmental taxes totalled €324.6 billion in the EU, with 77 % being collected from energy taxes. One way of mitigating the risk to poorer households is to redistribute the revenue from these taxes.

In the report 'Energy taxation and its societal effects', JRC experts analyse energy taxation and the current context in which it functions, as well as policies that influence the energy bills of EU citizens. Energy taxes differ considerably between countries, sectors and fuels.

The rising cost of energy and transport across Europe

Energy prices have increased substantially over the last two decades, mainly driven by a growth in network charges, taxes and levies. Taxes and levies make up 40 % of the average electricity prices in the EU. In 2018, the poorest European households (those in the lowest 10% income bracket) spent 8.3 % of their expenditure on energy.

By region, northern and western European middle-income households spent 3-8 % of their expenditure on energy bills in 2018, while central and eastern Europeans with the same income level spent 10-15 %. For the poorest households, the picture varies across EU countries: they spent slightly more than 20 % of their expenditure on energy costs in Slovakia and Czechia, and less than 5% in Luxembourg, Finland and Sweden.

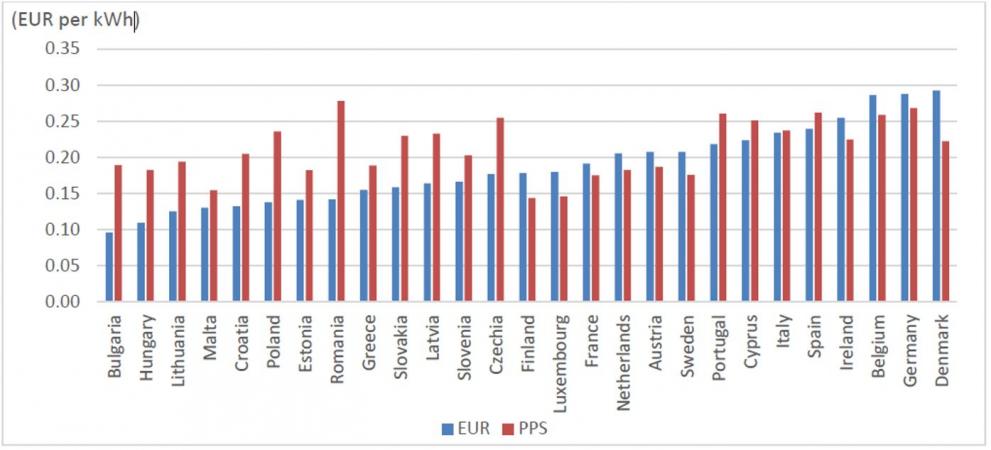

The EU’s poorest households spent on average €945 on energy in 2018, ranging from less than €500 in some EU countries to €2500. However, purchasing power varies considerably across the countries: when considering this factor alongside electricity costs in the second half of 2019, people living in Romania paid the most for electricity in the EU, and people in Finland the least.

What to do with the tax revenue?

Revenue from energy taxes in the EU is not earmarked for specific use. Governments decide how they want to allocate the collected revenue: it can contribute to a budget surplus or alleviate a budget deficit, provide room for discretionary increases in government expenditures, or discretionary reductions in other taxes.

On the environmental side, the revenue can potentially be used by a government to increase its expenditure on environmental protection or efficient management of natural resources.

If targeted effectively, some of the revenue can also be used to cushion the impact on poverty and inequality. Re-investing tax revenue through special schemes such as renovation or renewable energy subsidies can help to reduce energy poverty among financially vulnerable households. Another option is lump-sum transfers for households, to help those who would otherwise be disproportionally affected by higher energy taxes.

Background

The way energy taxation revenue is used can have important consequences, especially if the taxes, and therefore, the revenues are predicted to grow in the future.

Taxes account for a significant share of the final price of energy products in the EU. The Energy Taxation Directive lays down the minimum levels of taxation for products used as motor or heating fuel and for electricity. The Directive is currently being revised to better align taxation to the EU’s current climate objectives.

The Commission’s 2030 Climate Target Plan highlights that the use of environmental tax revenues could lead to a reduction in labour taxation, with positive effects on employment. It also states that these revenues could be used to invest in innovation and modernisation towards a green economy.

The Impact Assessment accompanying the 2030 Climate Target Plan shows that the estimated changes in relative prices generated by higher climate ambition would indeed affect lower income earners significantly more than top income earners. The analysis also shows that carbon revenue at a national level would be sufficient to compensate those income groups who are affected the most

Related Content

JRC report: Energy taxation and its societal effects

Details

- Publication date

- 22 March 2021