The coming electric vehicle boom will significantly increase the demand for cobalt in the EU and globally.

As a result, demand is expected to exceed supply already in 2020 and the EU must take steps to boost supply and curb demand without hindering the growth in electric vehicles, according to a new JRC report presented at the EU Raw Material Week in Brussels.

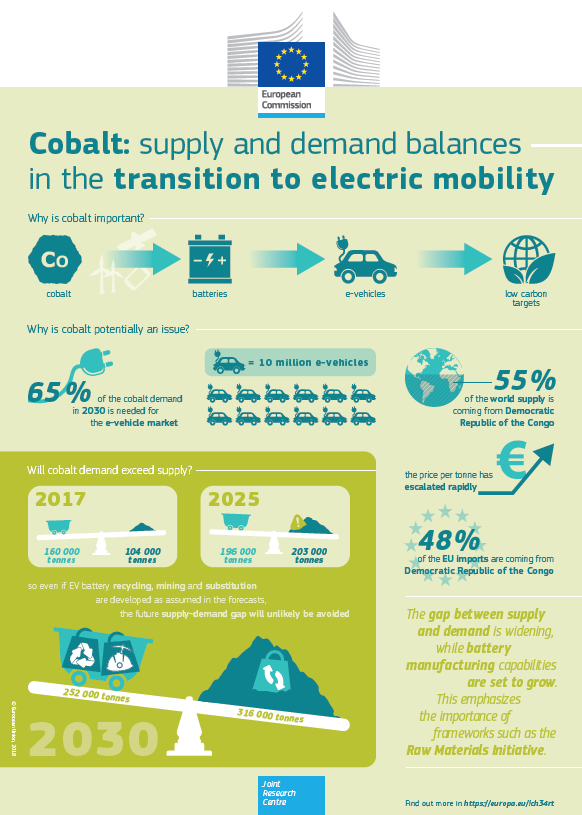

Cobalt, a critical raw material for electric transport

Cobalt is necessary for the production of the most common types of lithium-ion batteries, which in turn are powering the current boom in electric vehicles.

And while the switch from combustion engines could significantly reduce greenhouse gas emissions, it could also create bottlenecks that may stall the process unless they are identified and addressed early on.

As the world's electric vehicle stock is expected to grow from 3.2 million in 2017 to 130 million in 2030, the overall demand for cobalt could increase threefold within the next decade, outstripping supply already in 2020.

EU and global demand for and supply of cobalt

Annual cobalt production in the EU is around 2 300 tonnes, while demand is already about nine times higher.

As the gap between supply and demand is expected to increase in the next decade, the EU will continue to depend on imports for the foreseeable future.

Whereas in 2017 65 % of the world cobalt mine production (160 000 tonnes) was enough to satisfy the global demand (104 000 tonnes), the latter is expected to skyrocket in the next decade.

The report predicts that, under average conditions, demand will outgrow supply by 64 000 tonnes in 2030.

Cobalt supply chain at risk of concentration disruption

However, the global supply chain of cobalt is fragile due to extreme concentration. On the one hand, more than half of the worldwide supply (126 000 tonnes) is mined in the Democratic Republic of Congo.

On the other hand, China produces almost half of the world’s refined cobalt.

According to the JRC report these risks will persist in the future, increasing in the short term but potentially decreasing between 2020 and 2030, when currently ongoing exploration projects could add new suppliers and diversify the market.

Rising prices may impact battery production

Cobalt prices have tripled between 2015 and 2018. A continued trend might seriously impact battery manufacturing, as cobalt accounts for a significant part of production costs.

Substituting cobalt with other metals is technically possible and could reduce demand from electric-vehicle manufacturing by almost 30%.

However, substitution will not be enough to resolve imbalance in the mid-to-long term.

How to improve cobalt supply stability – proposed actions

As the EU continues to develop its battery manufacturing capacity, it is crucial to secure adequate cobalt supplies which are obtained sustainably.

The report highlights the importance of EU initiatives such as the Raw Materials Initiative pillars and the European Battery Alliance and suggests specific actions which could improve the cobalt market situation in the future, such as:

- promoting cobalt extraction and attracting private investment into minerals exploration by improving regulatory conditions;

- consolidating trade agreements with countries such as Australia and Canada, whose importance as cobalt producers is expected to grow in the future;

- ensuring that used batteries, including those from plug-in hybrid electric vehicles, are collected efficiently in order to boost cobalt recycling;

- exploring ways to bring low-cobalt battery chemistries and cobalt-free alternatives to the market;

- monitoring the supply-and-demand situation of metals which could potentially substitute cobalt, such as nickel.

Background – the European Battery Alliance

The European Battery Alliance was launched by Vice President Šefčovič with Member States and industry in October 2017.

In less than one year, the Commission Action Plan is in place, the first pilot production facilities are being built and further projects are announced to establish the EU as the lead player in the strategic area of battery innovation and manufacturing.

Related Content

JRC report: Cobalt, demand-supply balances in the transition to electric mobility

Details

- Publication date

- 13 November 2018