On 21 March 2018, the Commission presented its proposal establishing rules at EU level to ensure the fair and effective taxation of the digital economy.

JRC scientists have supported the package by providing data and estimates on corporate profit allocation of Web companies and by analysing the macroeconomic impact of the proposal.

The current designs of national corporate tax systems date back to times when productions, technologies and international trade activities were more easily tracked and value generation could be associated with companies´ location of employees and physical assets such as buildings and machinery.

With the digital economy things become more intricate. Value creation becomes more associated with data and intangible assets which do not necessarily co-locate with traditional assets. As a result digital companies can have a lower effective tax rate than other, more traditional businesses.

In recent years tax systems have been trying to cope with new challenges posed by the digital economy, which is also gaining importance in the economy.

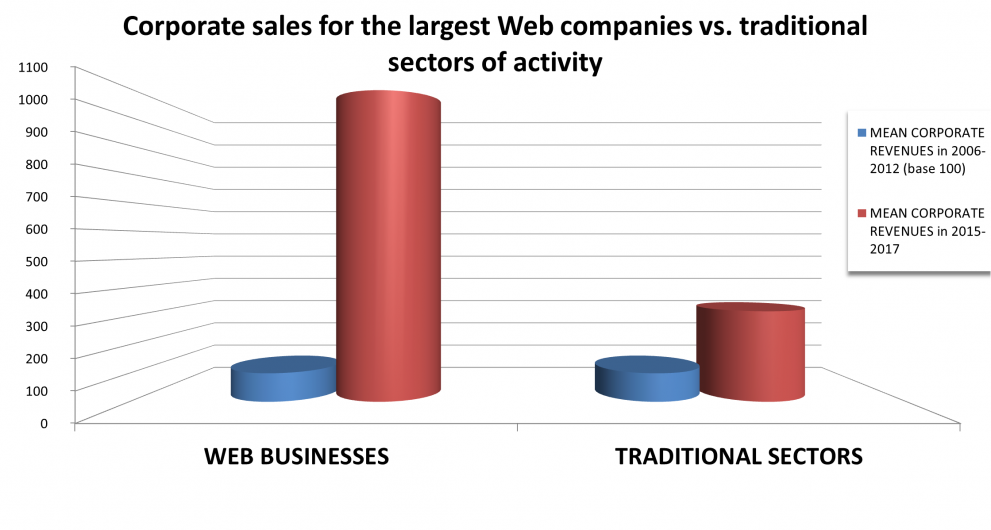

While the size of the digital economy is still relatively small when compared to analogous "brick-and-mortar" industries, its growth has been phenomenal in recent years.

Although the digital economy has brought visible gains in productivity and important innovations, there exists a mismatch between the place where value is generated and where it is formally declared and taxed.

JRC support to the taxation package

The JRC has documented the extent of the mismatch between value generation and profit allocation in the digital economy and calculated the likely macroeconomic effects of the proposals.

A specific methodology was developed that exploits data on the use of Web domains by the EU Member States.

By assigning Web domains to a company and then summing up page views, visitors and likely Web-metric measures divided by source country, it is possible to estimate the share of consumption of Web products and services that grow over time for each country.

JRC researchers used Web-metrics to apportion global turnover of Web companies to each EU Member State, thus obtaining an estimate of the potential tax bases that would be available if the corporate tax system were inspired by a destination principle (i.e. value is taxed at the place of final consumption).

The JRC also evaluated the effects of the comprehensive solution proposed by the package using the CORTAX macroeconomic model. The results predict an increase of investment, GDP and jobs in the EU.

Related Content

Details

- Publication date

- 21 March 2018