The Joint Research Centre (JRC) has developed a new JRC EUROMOD website which will gather all the information about the EUROMOD model for the European Union.

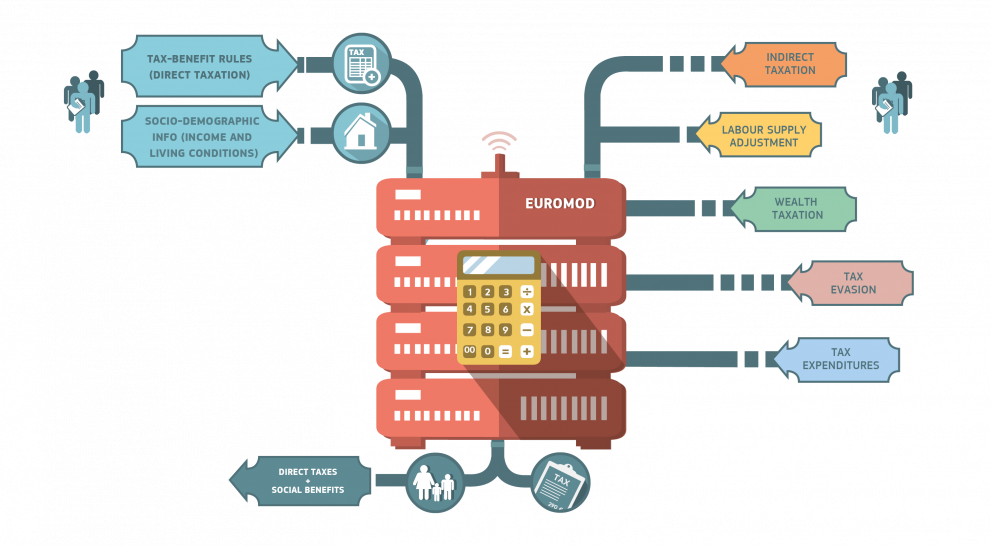

EUROMOD is the state of the art tax-benefit microsimulation model for the European Union. It enables researchers and policy analysts to simulate personal income tax, social insurance contributions or social benefit reforms to calculate the budgetary and personal income implications of those reforms. EUROMOD covers all EU Member States. Initially developed and managed by the University of Essex, the tool has been transferred to the JRC of the European Commission, with Directorate-General Eurostat (DG ESTAT) acting as main data provider. This transfer will be fully and successfully completed by the end of 2020.

This new website is a key element of the project since it provides the EUROMOD community with online access forms to request access to the model and data, manuals, detail information on the model, events, news…

How is Euromod used?

The JRC uses the EUROMOD model for the impact assessment of tax and social benefit reforms since March 2013. In the context of the European Semester, EUROMOD was recently used to perform an analysis of income guarantee schemes and child poverty in Spain and to assess the redistributive impact of some measures favourable to households’ disposable income in France, among other studies.

Additionally, the JRC uses EUROMOD and its extensions to carry out a series of thematic studies. During the current year several thematic studies focused on the COVID impact on household incomes, minimum income, tax expenditures, and net fiscal impact of migration flows have been performed.

EUROMOD also plays a key role in the technical assistance that the JRC provides to some EU Member States (Greece, Lithuania, Slovakia and Romania).

EUROMOD is not only used within the European Commission, but also in academic analyses with an increasing number of users, publications and citations in this context.

Details

- Publication date

- 23 November 2020