China is strategically expanding industries with the highest all-encompassing gains for its whole ecosystem.

Chinese exports rise hand in hand with improving technological competitiveness.

The largest gains in Chinese competitiveness are in ICT, electrical, machinery and rail industries.

The structural reforms and large targeted investments in high-tech fields may result in allowing China to become an innovation leader by 2049, or sooner in some areas.

China's industrial strategy cuts across several aspects of joint relevance.

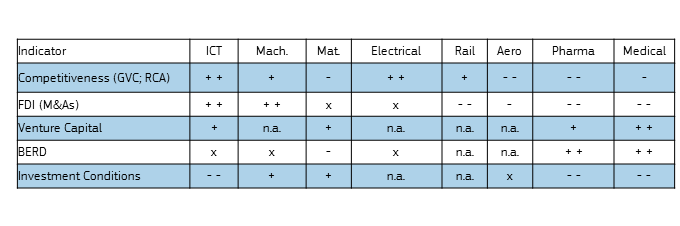

Participation in manufacturing global value chains (GVCs) and revealed comparative advantage in exports (RCA) reflect the international competitiveness of an economy.

In the Chinese case, one can observe a particularly strong performance in the ICT and electrical component sectors, while China also performs well in railways and machinery.

In the pharma, medical equipment and aerospace sectors the performance is instead relatively lower, while the same sectors receive substantial amounts of Business Expenditure on Research and Development (BERD) and venture capital.

Interestingly, pharmaceutical and medical also present investment conditions that strongly favour domestics companies.

This whole picture suggests therefore how restrictive foreign investment conditions alone are not enough to determine the international success of a sector, as the pharmaceutical and medical sectors illustrate.

They score relatively low on competitiveness despite high BERD and venture capital, which may indicate an effort to make up for China’s relatively weak knowledge position in these fields compared to the US and the EU, while not being supported by strategic mergers and acquisitions.

As shown by the performance in high-tech sectors, China's improvements appear to originate from a combination of productivity-enhancing investments and technological developments while benefiting from sheltering foreign investment conditions.

The report

China – Challenges and Prospects of an Industrial and Innovation Powerhouse

Related Content

Report: China – Challenges and Prospects of an Industrial and Innovation Powerhouse

China Country Analysis - information on R&I policies and performances for China.